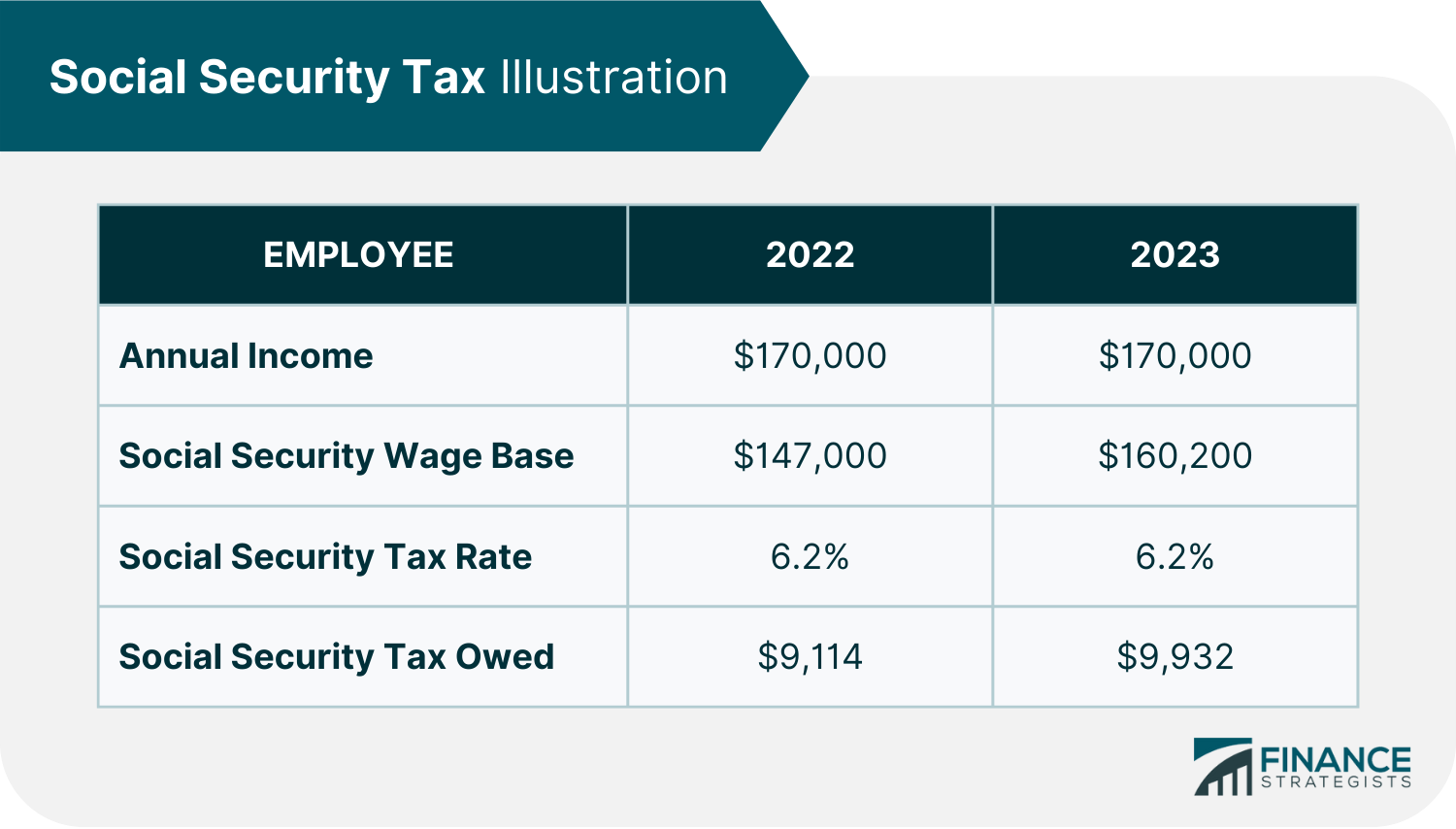

Maximum Social Security Tax 2025 Increase - Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). This amount is known as the “maximum taxable earnings” and changes each. Tax rates for the 2025 year of assessment Just One Lap, What’s the maximum you’ll pay per employee in social security tax next year? This is up from $9,932.40.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). This amount is known as the “maximum taxable earnings” and changes each.

Max Ss Benefit 2025 Kyle Shandy, In 2025, the social security tax limit rises to $168,600. 1.45% medicare tax on the first $200,000 of wages ($250,000 for joint returns, $125,000 for married taxpayers filing separate returns), plus.

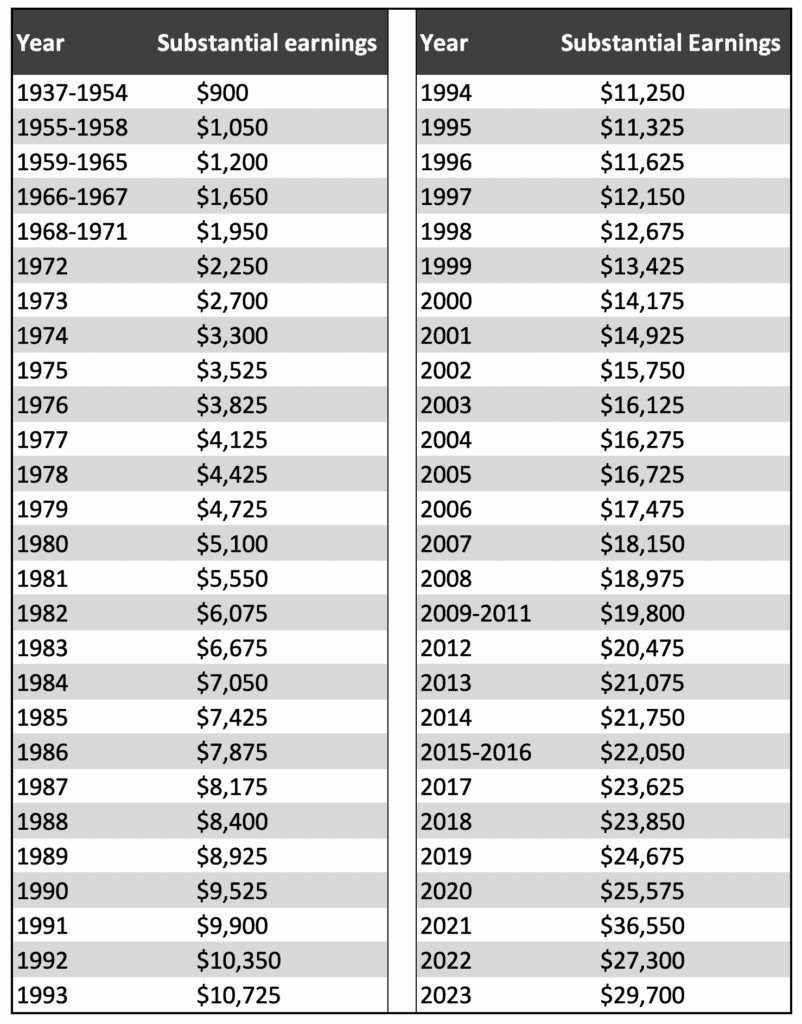

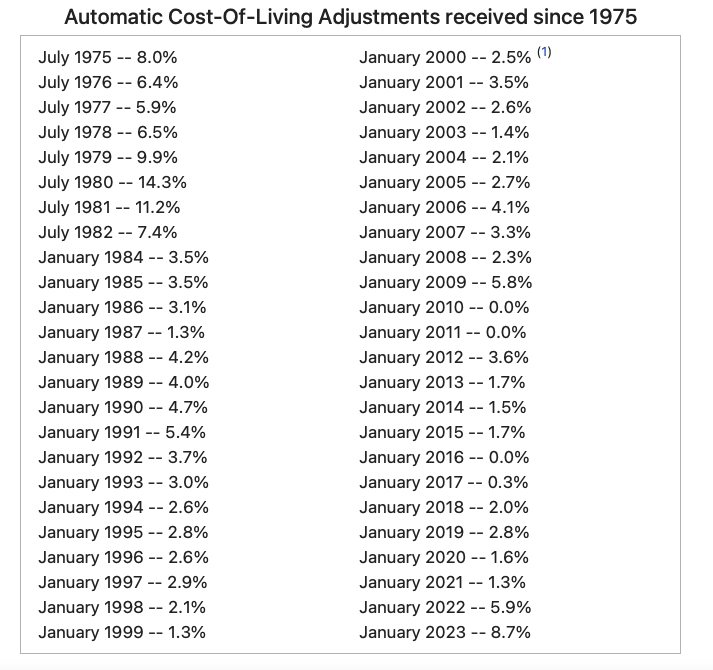

Social Security Pay Chart 2025 Elise Corabella, 2025 social security tax limit increase. The wage base or earnings limit for the 6.2% social security tax rises every year.

In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

This is up from $9,932.40. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 is $10,453.20 ($168,600 x 6.2%).

Will Social Security Benefits Increase In 2025 Gale Pearla, The wage base or earnings limit for the 6.2% social security tax rises every year. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

1.45% medicare tax on the first $200,000 of wages ($250,000 for joint returns, $125,000 for married taxpayers filing separate returns), plus.

Maximum Social Security Tax 2025 Increase. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). The taxable wage base estimate has been released, providing you with key numbers.

All changes in Social Security for 2025, This amount is known as the “maximum taxable earnings” and changes each. In 2025, the highest amount of social security tax that will be deducted from an.

The maximum amount of earnings subject to social security tax (taxable maximum) will increase to $168,600 from $160,200.

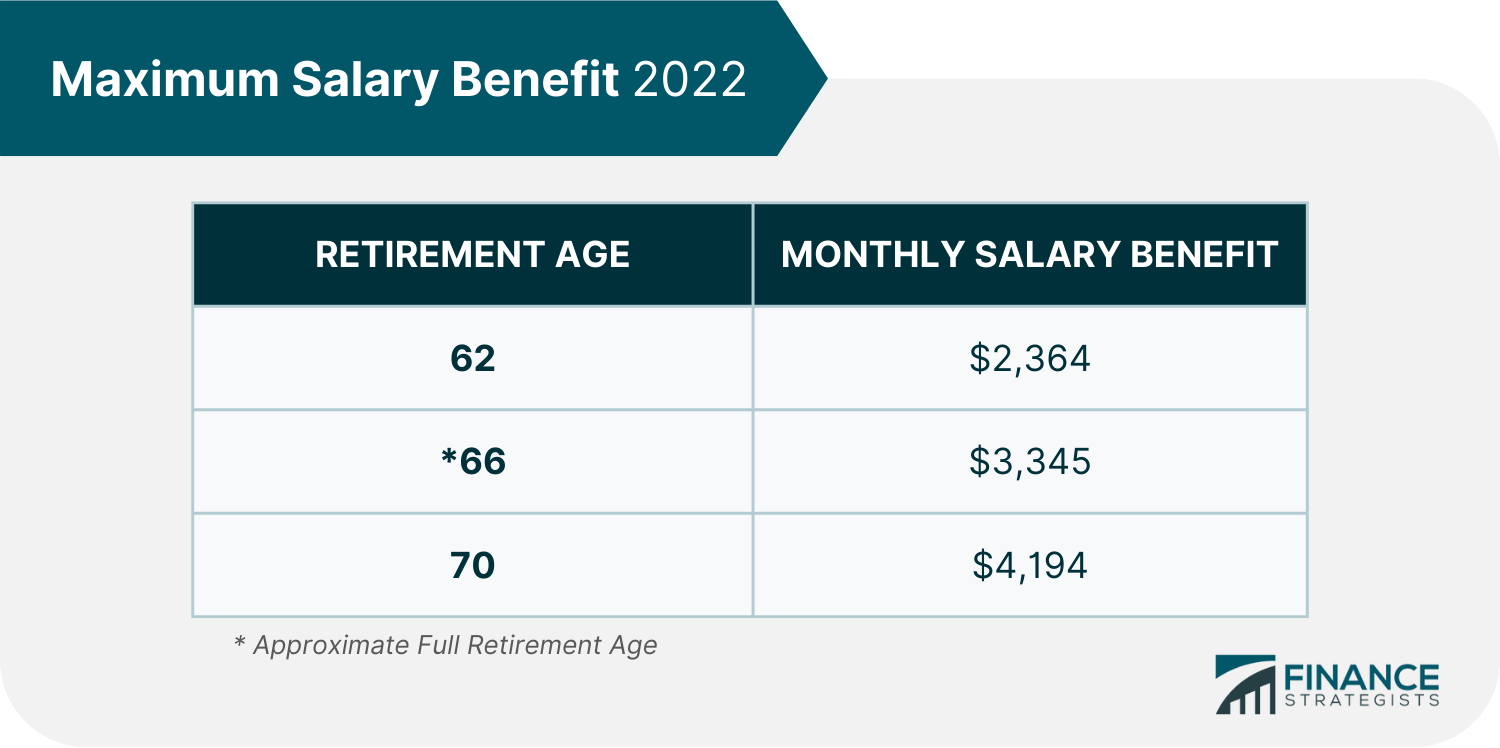

2025 Maximum Social Security Taxable Maire Roxanne, But retirees who receive the maximum social security payout will see much higher earnings, with their monthly checks jumping to $4,873 in 2025, according to the. In 2025, the highest amount of social security tax that will be deducted from an.